As the construction industry continues to evolve, the demand for reliable and efficient machinery remains paramount. Tower cranes play a critical role in modern construction projects, and the market for used tower cranes is thriving. According to a recent report by the Global Construction Machinery Market Analysis, the used crane market is projected to grow by 5.3% annually over the next five years, driven largely by the increasing need for cost-effective machinery solutions. Among these, the Used Liebherr Tower Crane has garnered significant attention for its robust design and superior performance, making it a favored choice among contractors seeking to optimize their investments.

Industry expert and construction machinery analyst, John Smith, highlights the growing preference for used equipment, stating, "Investing in a Used Liebherr Tower Crane not only reduces costs but also provides access to advanced technology that enhances operational efficiency." As we look ahead to 2025, understanding the trends surrounding the used Liebherr options is vital for businesses aiming to remain competitive. Factors such as fluctuating construction project demands, the availability of specific models, and maintenance considerations are crucial aspects that potential buyers must navigate. By keeping an eye on these trends, one can make informed decisions that align with the ever-changing landscape of the construction industry.

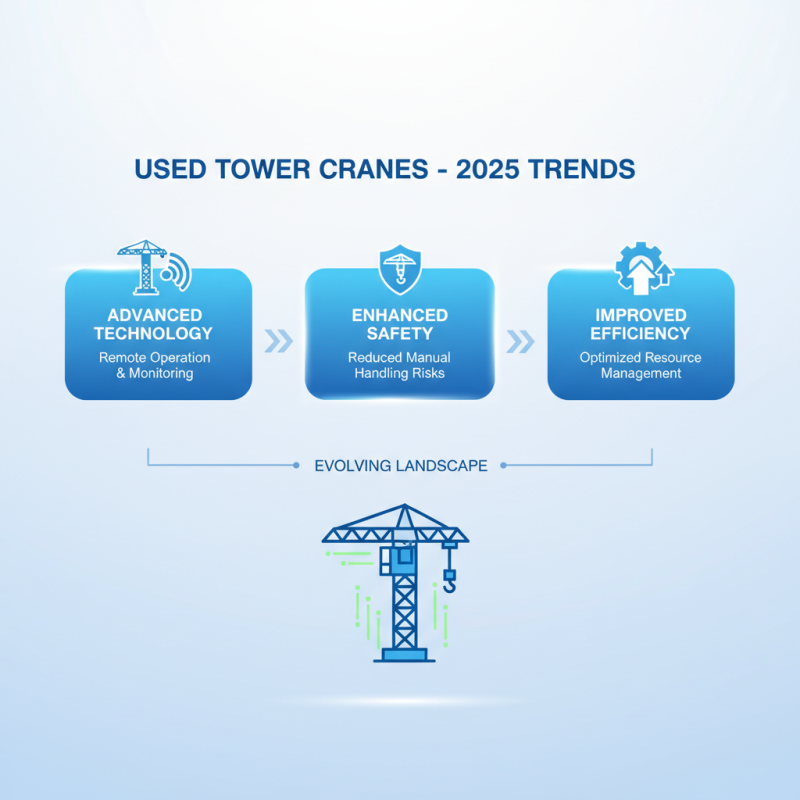

In 2025, the landscape of used tower cranes is evolving, with a particular emphasis on key features that enhance functionality and efficiency. One of the most significant trends is the incorporation of advanced technology into the design of these cranes. Features like remote operation capabilities and integrated monitoring systems allow for improved safety and productivity on construction sites. Operators can now oversee crane operations from a distance, reducing risks associated with manual handling and enabling better management of resources.

Moreover, durability and maintainability are becoming pressing considerations for users of used tower cranes. Enhanced materials and technologies are being used to extend the lifespan of these cranes, making them more appealing to buyers who are looking for long-term investments. Regular maintenance protocols, often integrated into the crane's design, facilitate easier access for repairs and servicing, thereby minimizing downtime and ensuring continuous operation. As the demand for more sustainable building practices grows, the trend towards energy-efficient models is also gaining traction, highlighting the importance of environmentally friendly options in the heavy equipment market.

The market for used tower cranes has witnessed significant growth in recent years, driven by an increasing demand in the construction sector. According to a report by Research & Markets, the global used tower crane market is expected to grow at a compound annual growth rate (CAGR) of over 6% from 2023 to 2028. This surge is predominantly fueled by ongoing urbanization and infrastructure development, particularly in emerging markets where construction activities are ramping up. The availability of cost-effective used models enables construction companies to meet project demands without straining their budgets, aligning well with the industry trend towards value-oriented purchasing.

As the industry evolves, several key trends have emerged. Notably, there is a heightened focus on sustainability and efficiency, prompting companies to consider used tower cranes that offer both reliability and reduced environmental impact. A survey conducted by the Construction Equipment Manufacturers Association reported that 35% of contractors now prioritize emissions and fuel efficiency as critical factors when selecting cranes. Furthermore, technological advancements in older models—such as improved operational controls and safety features—have made them more appealing to firms looking to optimize their fleet without investing heavily in new equipment. This transition reflects a broader trend in the construction sector, where maximizing resource utilization and minimizing waste have become standard practices.

In the rapidly evolving market of used tower cranes, the demand for options in 2025 underscores the necessity for a thorough comparative analysis among prominent brands. As per industry reports by the Construction Equipment Association, the used tower crane market is projected to witness a growth rate of approximately 8% annually, driven by increased urbanization and infrastructure projects worldwide. This growth leads to heightened competition, particularly among established manufacturers and their used models.

When assessing the various options, market analysts point out that several factors—such as lifting capacity, height reach, and technology integration—are crucial to making informed decisions. Data from the European Construction Equipment Market Report emphasize that cranes with advanced automation features and energy-efficient designs tend to retain their value longer, emphasizing the importance of these attributes in comparing different brands. As companies look to optimize their operations, understanding the specifications and performance metrics of each brand's offerings becomes essential, ensuring that buyers choose equipment that aligns with their project requirements and budget considerations.

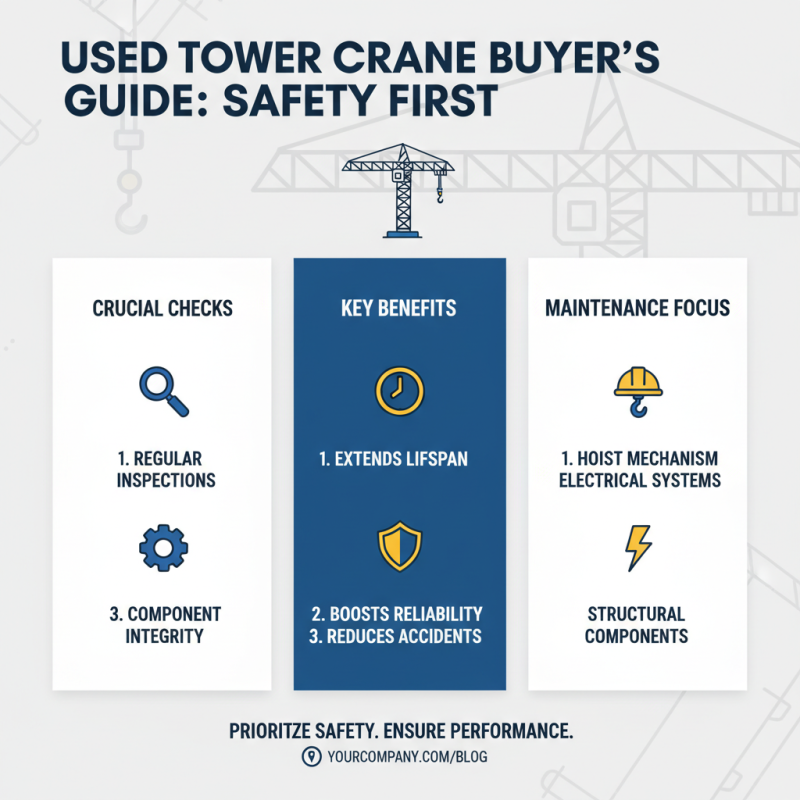

When considering the purchase of used tower cranes, maintenance and safety aspects should be at the forefront of any decision-making process. Regular inspections are crucial, as they ensure the crane's functionality and reliability. Buyers should look for equipment that has a documented maintenance history, which indicates consistent care and adherence to safety standards. This practice not only prolongs the lifespan of the crane but also minimizes the risk of accidents on site. Proper maintenance includes checking critical components such as the hoist mechanism, electrical systems, and structural integrity, which are essential for safe operation.

Safety considerations further extend to the certification and training of personnel involved in operating the crane. Ensuring that all operators are well-trained and knowledgeable about the specific used equipment is vital. This includes understanding the crane's load limits, operational range, and emergency procedures. Additionally, compliance with local safety regulations should be prioritized to mitigate liability and enhance the overall safety culture on construction sites. By addressing both maintenance and safety comprehensively, owners of used tower cranes can optimize their equipment’s performance while safeguarding their workforce.

When considering the purchase of used tower cranes, financing options become a crucial factor for buyers. With the construction industry continuously evolving, many companies look for budget-friendly solutions that allow them to acquire reliable equipment without draining their financial resources. There are various financing methods available that can cater to different business needs, from traditional loans to leasing options. Understanding these choices can help companies make informed decisions that align with their financial strategies.

Leasing, for example, can be an attractive option for businesses that prefer to keep their capital available for other investments. This method allows companies to use the cranes while making manageable rental payments, ultimately leading to lower upfront costs. On the other hand, installment loans provide an opportunity to own the equipment outright while spreading the cost over time. Buyers can assess their cash flow and financial stability to determine the ideal financing route, ensuring that they can meet their operational requirements without overextending themselves.

| Model | Year of Manufacture | Max Load Capacity (tons) | Height (meters) | Price Range ($) | Financing Options |

|---|---|---|---|---|---|

| Model A | 2018 | 10 | 40 | 25000 - 30000 | Lease, Installment Payment |

| Model B | 2016 | 12 | 45 | 22000 - 27000 | Finance, Trade-in Options |

| Model C | 2020 | 8 | 35 | 20000 - 25000 | Loan, Rent-to-Own |

| Model D | 2019 | 15 | 50 | 30000 - 35000 | Flexible Payment Plans |